Safaricom Partners With Visa In Launching M-PESA GlobalPay For Global Payments

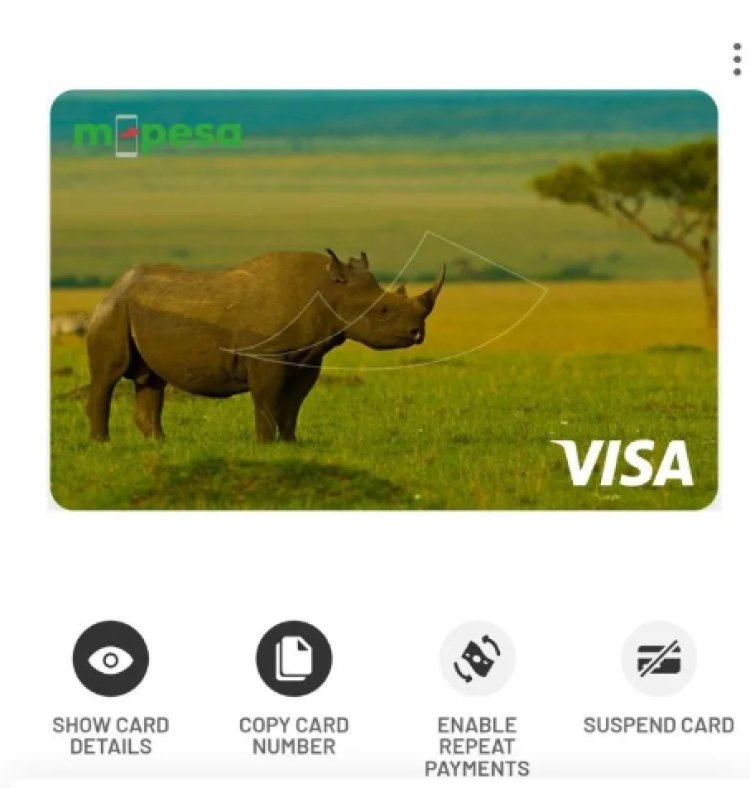

Safaricom has launched M-PESA GlobalPay, a virtual Visa card linked to the M-PESA account that allows users to make secure payments on global websites.

On Thursday, Safaricom revealed that the new M-Pesa Visa virtual cards will allow Kenyans to purchase globally by facilitating safe cashless payments at merchant locations in over 200 countries via Visa's worldwide network.

Peter Ndegwa, CEO of Safaricom, said that the virtual card will bridge the gap for those who would like to use M-PESA anywhere across the world.

Corine Mbiaketcha, Visa Vice President and General Manager for East Africa, said during the launch that Visa is committed to extending the payments ecosystem across Africa by allowing every customer access to the global marketplace.

Safaricom explained that customers can activate the card by selecting M-PESA GlobalPay under the "Pay" or "Grow" option on the M-PESA App. They may also activate it by phoning *334#, then choosing option 6 for "Lipa Na M-PESA," then "M-PESA GlobalPay."

Both solutions will necessitate the usage of the customer's secret M-PESA PIN. The customer can then access their Mini-Statement, examine their card details, and produce the "CVV" required to confirm online card transactions, manage their cards, set up repeat payments, and access their Mini-Statement.

Customers would be protected from incurring forex conversion expenses on local online payments billed in Kenyan Shillings using the M-PESA GlobalPay Visa Virtual Card exclusively for international online payments outside Kenya.

Transactions will be limited to KES 150,000 per transaction and KES 300,000 per day on M-PESA at the current Forex rates. When a customer uses the card to make a purchase, they will receive an SMS with the current exchange rate for the transaction amount.

The M-PESA GlobalPay Visa virtual card not only gives users the freedom and convenience of transacting anywhere in the globe, but it also adds to M-security PESA's by allowing customers to produce a unique CVV for a 30-minute period.

Each time a CVV is generated, customers will enter their M-PESA PIN. This feature ensures that only the consumer has access to all card information needed to complete a transaction.

Under a strategic partnership between M-PESA Africa and Visa, the M-PESA GlobalPay Visa Virtual Card will gradually be offered across other M-PESA markets via the M-PESA Super App. Tanzania, the Democratic Republic of Congo, Mozambique, Lesotho, and Ghana are among the MPESA markets to benefit from the partnership.